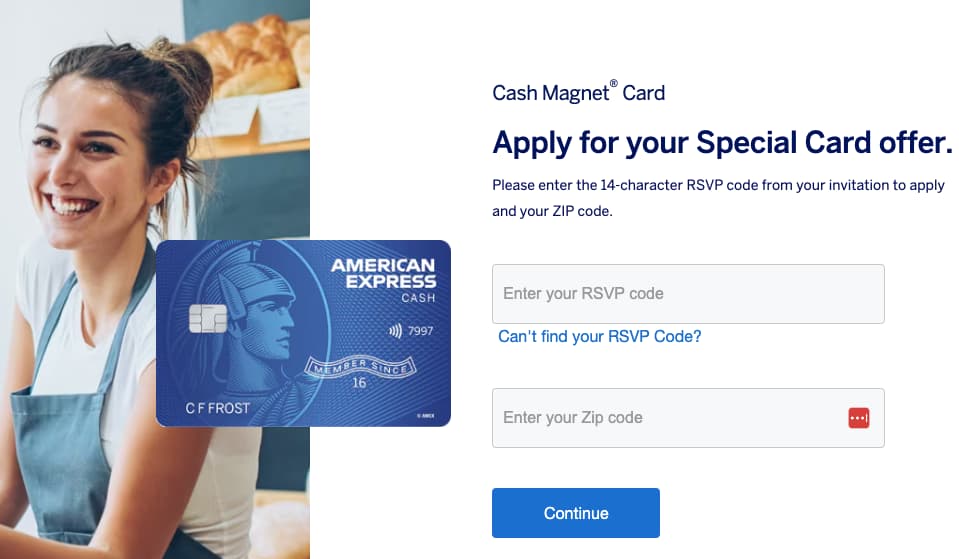

The advent of NewCardApply com 27167 has sparked a revolution in the online credit card application process.

With an amazing collection of features, this modern platform has made it more comfortable than ever for customers to guide the difficult and often puzzling world of credit cards.

One of the most striking features of newcardapply.com 27167 is its ability to compare offers from the top issuers in the industry.

This means that users can easily view and evaluate a range of credit card options, making it simpler to identify the card that best meets their needs.

Whether you’re looking for a low-interest rate, a generous rewards program, or other specific features, newcardapply.com 27167 can help you find the right card for you.

NewCardApply com 27167

In addition to its comparison tools, newcardapply com 27167 offers users a variety of resources and information to help them make informed decisions about their credit card choices.

From expert tips on managing credit to helpful guides on choosing the right card, this platform has everything you need to improve your financial well-being.

But what really sets newcardapply.com 27167 apart is its user-friendly interface and streamlined application process.

With just a few clicks, users can apply for the card of their choice and get a decision in minutes. This saves time and hassle and makes the application process a breeze.

Newcardapply com 27167 is a game-changer in the world of credit cards. With its creative features, extensive resources, and easy-to-use interface, this platform is a must-have for anyone searching to enhance their financial health.

How to Apply for Ameris Bank Platinum Visa Card?

This premium credit card boasts a low-interest rate and a collection of unique features that make it the best choice for numerous customers.

How can you secure this coveted credit card? Don’t worry, for we have summarized the application procedure and provided you with useful information to assure that your application is successful.

-

Step 1: Assess Your Credit Score

Before you even consider applying for the Ameris Bank Platinum Visa Card, it is important that you monitor your credit score.

Your credit score is an important element in the credit card application process, and it gives you insight into your creditworthiness.

A score of 700 or above is generally considered ideal. It is essential to mention that the higher your score, the more useful your probability of being supported for this card.

-

Step 2: Collect Your Personal Information

To apply for the Ameris Bank Platinum Visa Card, you must provide detailed personal information.

You must also provide information about your work and payment, so be sure to have your salary or tax returns in handy.

-

Step 3: Apply Online

After collecting all your personal and financial information go to the official link to apply, you can start the application procedure for the Ameris Bank Platinum Visa Card.

The online application procedure is fast and uncomplicated, and you should be able to complete it in minutes.

When completing the application, make sure to give valid and updated information, as any errors or deletions could result in a delay in the processing of your application.

-

Step 4: Wait for a Response

After submitting your application, you must wait for a response from Ameris Bank.

The bank will check your application and credit score to determine whether you allow for the Ameris Bank Platinum Visa Card.

If your application is authorized, you will get your new card within a few business days. In case of a rejection, you will receive a letter in the mail summarizing the grounds for the rejection.

Suggestions for Success

- To improve your probability of being approved for the Ameris Bank Platinum Visa Card, there are many actions you can take.

- It is important to have a good credit score by paying your bills on time and keeping your credit card balances low.

- Make sure that all the information you provide is accurate and updated. Any errors or deletions could delay the processing of your application.

- If you are denied the Ameris Bank Platinum Visa Card, do not be disappointed.

- You can always perform on improving your credit score and apply again in the future.

Products and Services offers by Ameris Bank for Retail Banking

In the empire of banking, consumers have an overwhelming collection of options to select from, each providing a dizzying collection of services and products.

Ameris Bank, however, is a standout amongst the crowd, providing a top-tier selection of retail banking services.

With a diverse range of products that serve the everyday banking requirements of individuals, Ameris Bank is a trusted option for those searching for stability and security in their financial dealings.

-

Checking and Savings Accounts:

Ameris Bank’s checking and savings accounts are designed to satisfy the unique financial requirements of their customers.

Their checking accounts provide a lot of features such as online and mobile banking, overdraft protection, and more, with no minimum balance needs.

Their savings accounts come with competitive interest rates and options such as CDs, money market accounts, and more.

Ameris Bank understands that no two customers are alike, and that’s why they provide a combination of options to fit each individual’s financial situation.

-

Credit Cards:

Ameris Bank’s credit cards are a cut above the rest, providing a range of competitive rewards and advantages that make them a top choice for many consumers.

Their credit cards are available with cashback rewards, low-interest rates, travel rewards, and more. Further, their cards have no annual fees and are accepted worldwide, making them a suitable and cost-effective option for everyday purchases.

Ameris Bank’s credit card offerings are designed to provide their customers with the purchasing power they require to live their lives to the fullest.

-

Loans:

Ameris Bank provides a range of loan products, including personal loans, home equity loans, and mortgages. Their loan products come with competitive rates and flexible terms that are designed to fulfill the specific requirements of their customers.

Whether you’re looking to finance a new home or just require a small loan to cover unwanted expenditures, Ameris Bank has a lending solution that can assist.

Their fast and straightforward loan application procedure makes sure that customers can access the funds they require when they need them.

-

Other Services:

Ameris Bank also provides a range of other services to their customers. These include online and mobile banking, bill pay, eStatements, and more.

Their online and mobile banking platforms are user-friendly and provide customers with the flexibility and comfort they need to handle their finances on the go.

If you’re searching to deposit a check, transfer funds, or just check your balance, Ameris Bank’s online and mobile banking services have got you covered.

Who is Eligible to Apply for the Visa Platinum Credit Card?

Credit cards have become a universal factor of modern financial life, but the rules around eligibility for a particular card can be hard to parse.

Many consumers are unsure if they have the income or credit score needed to qualify for a credit card like the Ameris Bank Visa Platinum.

Nevertheless, understanding the eligibility requirements for this card is necessary to determine whether it’s the correct fit for you.

-

Age and Residence Prerequisites

To be eligible for the Ameris Bank Visa Platinum credit card, you should be a U.S. citizen and your age should be at least 18 years old.

These are essential needs that can apply to most credit cards on the market, but they are necessary to remind as you consider your choices.

-

Credit Score

Possibly the most important factor in determining if you are eligible for the Ameris Bank Visa Platinum credit card is your credit score.

You’ll require a score of at least 700 to be assessed for the card. If you’re not sure about your credit score is, you can track it online for free of cost.

-

Other Factors That Can Influence Eligibility

Even if you meet the basic eligibility requirements and have a good credit score, there are still some other factors that can affect your ability to get approved for the Ameris Bank Visa Platinum credit card.

If you have a stable job with a good income and a history of responsible credit use, your chances of approval may be higher.

-

Small Business Owners

Although the Ameris Bank Visa Platinum credit card is designed for personal use, it can also be a great option for small business owners searching for a credit card to help handle their expenses.

If you’re a small business proprietor, you’ll require to have your business information and financials on hand when you apply.

More Useful Guides:

- TDBank.com/GiftCardInfo

- AmericanExpress.com/ConfirmCard

- WellsFargo.com/ConfirmCard

- 888ExtraMoney Discounttire

- www RegisterMyBrother com

Conclusion:

The most important step in the credit card application procedure is reading the terms and conditions totally.

While it may be tempting to breeze through the fine print, doing so can result in unexpected fees, interest rates, and other unpleasant surprises.

Moreover, it is crucial for individuals to understand the fees and interest rates associated with each credit card option. Interest rates can differ widely, and even contrast of a few percentage points can add up over time.

Further, using credit responsibly is key to creating a solid credit history and bypassing long-term debt.

By making timely payments and bypassing overspending, individuals can take complete benefit of the advantages that credit cards provide without surrendering to the pitfalls of extreme debt.