In this guide, you will introduce with detailed information on mycreditcardunionbank application, benefits, requirements, and reviews 2023.

Union Bank is a top bank in the Philippines that delivers a wide range of financial products and benefits to its customers.

Established in 1916, Union Bank has a prosperous history of serving the financial requirements of the Filipino people and has developed to become one of the most extensive and trusted banks in the country.

Along With over 400 branches and more than 2,000 ATMs situated nationwide, Union Bank is a reputed bank to provide the needs of its customers, yet, of where they are located.

It provides a broad range of personal banking services to individuals, including checking and savings accounts, loans, insurance products, and investment opportunities.

MyCreditCardUnionBank

The bank also delivers commercial banking services to small and medium-sized businesses, large companies, government agencies, and financial organizations, supporting these organizations to develop and succeed.

More Useful Financial Guides:

- BankofAmerica.com/ActivateDebitCard

- Citi.com/CostcoAnyWhereApplyNow

- Accept.CreditOneBank.com Approval Code

About Union Bank

Union Bank offers commercial banking services to corporate clients, including SMEs, big organizations, and government entities.

Union Bank is a reputed and popular financial institution that offers a variety of financial products and assistance to its customers. Branches of Union Bank are located nationwide, particularly in Metro Manila where it has more than 20 branches.

It provides personal banking services to people, SMEs, large corporations, government agencies, and financial institutions.

How do Credit Cards of Union Bank work at MyCreditCardUnionBank?

Union Bank offers credit cards to all its account holders in the Philippines. These credit cards provide a suitable and secure method for payment for daily expenditures and can be used in more than 400,000 locations across the country. Customers can choose types of credit cards such as Gold and Platinum according to their preferences.

How to Apply for a Credit Card from Union Bank?

You can begin by visiting Union Bank’s website and choosing the credit card that fits your requirements. If you already have an account with Union Bank, just click on the credit card and the “Apply Now” button will become visible. You will be directed to the application page where you can submit your information by clicking this button.

Remind that Union Bank values your financial security and may need specific information and documentation to confirm your identity and credit history.

This helps to confirm that your credit card is only used by authorized individuals and lowers the chance of scams. Upon receipt of your application, Union Bank will inspect it and provide you with a conclusion in a timely manner.

If your application is sanctioned, you will get your new credit card through the mail and be capable to begin using it right away.

Requirements of Union Bank’s Credit Card “MyCreditCardUnionBank”:

To apply for a credit card from Union Bank at MyCreditCardUnionBank com, you must complete the following minimum credentials and prerequisites, as expressed on their website:

- Applicants should be between the ages of 18 and 70.

- Submit a totally finished application form.

- Provide a copy of a valid government-issued ID along with a photograph and signature.

- Current verification of income, such as an Income Tax Return, Certificate of Employment, or recent bank statement.

- Foreign applicants must also submit an Alien Certification of Registration.

Note that these prerequisites may differ based on the kind of credit card you are applying for.

Union Bank Credit Card Interest Rates and Fees:

All Union Bank credit cards have a specified monthly interest rate of 2%. Nevertheless, the fees associated with each card type vary.

How to check the Status of Your Union Bank Credit Card Application?

Applicants can use the messenger app, m.me/TalkToRafa to check the status of their Union Bank credit card application. You need to type “application status” and give your reference number.

How to Activate Your Union Bank Credit Card?

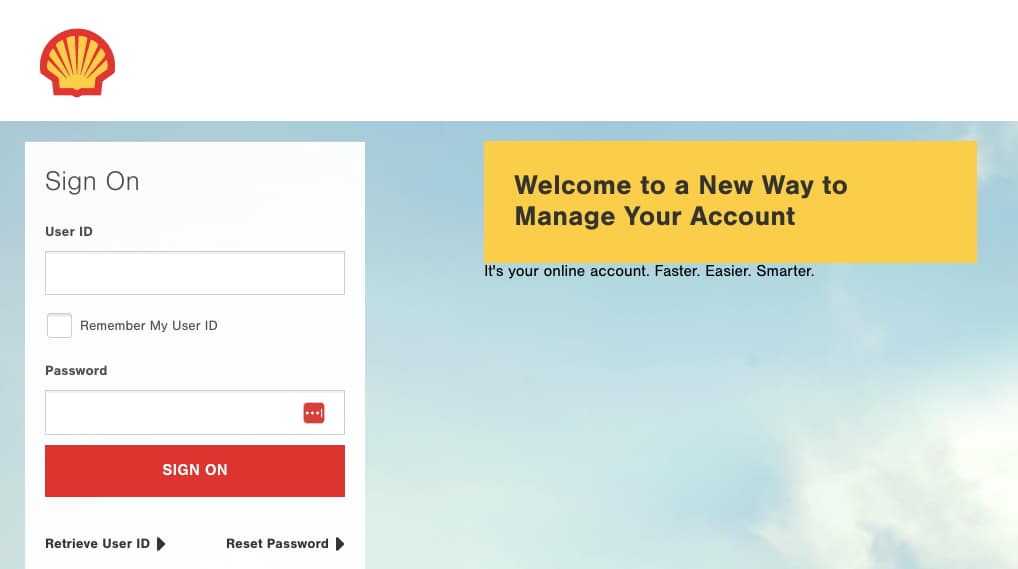

You can activate your Union Bank Credit Card in two ways: You can call 888-955-4141 or You can also visit the portal of My Credit Card at mycreditcard to activate your Union Bank credit card.unionbank.com.

Enter your credit card number, then register your account by creating a username and password. After successful authentication, you need to log in and tap on the link for activation.

How Long Does it Take to Receive a Union Bank Credit Card?

The verification procedure for a Union Bank credit card application can take up to 2 days. The physical delivery of the credit card can take anywhere between 5 to 10 business days.

The Credit Limitation for Union Bank Credit Card

The credit limit for a Union Bank credit card is determined based on the kind of card you prefer.

To determine the credit limit that best fits your requirements, it is recommended to get in touch with Union Bank.

Payment Options for Union Bank Credit Card

Union Bank provides a broad range of payment alternatives for its credit card customers, including over-the-counter payment at any of its branches nationwide. You can find the closest branch by visiting the Locations Pages of Union Bank.

Further, you can pay via e-wallets such as Gcash and PayPal.

Late Payment Fees

Assuming you are incapable to make a payment on time, Union Bank charges a late payment fee of PHP 1,000. The late fee for a Union Bank credit card can reach up to PHP 500.

Benefits of a Union Bank Credit Card

Union Bank offers cardholders a wide range of benefits, including the Union Bank Credit Card Rewards Program.

This program provides cash back, travel rewards, discounts on goods and services, as well as high-end credit card security and protection.

The card is also accepted worldwide and offers installment programs. Union Bank also offers car insurance and the ability to pay auto bills with your credit card.

Discounts and Promotions

Union Bank currently offers consumers a cashback option and flexible payment terms.

Cardholders can also receive vouchers from merchants such as Cebu Pacific and Power Mac Center, as well as discounts when using the credit card with travel merchants like Lihim Resorts and Kommons Boracay.

No Annual Fee

Union Bank credit card holders enjoy a waived annual fee as long as they maintain a minimum average daily balance of PHP 10,000.

Customer Support of Union Bank

For any queries or feedback concerning Union Bank’s products, you can contact the following sources:

-

Phone Number:

You can call the 24-hour customer service hotline at (02) 841-8600 for any assistance.

-

Hotline:

The hotline number is the same as the customer service number.

-

Email:

You can send an email to customer.service@unionbankph.com.

Feedback from MyCreditCardUnionBank

Union Bank, a leading bank in the Philippines, provides an assortment of credit cards to its customers.

They also provide competitive rates and extra advantages to cardholders. This is why they have continued to have an extensive client base and have received favorable feedback over time.

If you have used a Union Bank credit card, you can share your experience with us on MyCreditCardUnionBank.