Introducing platinum.capitalone.com/activate, the user-friendly platform designed to help you activate your new Platinum Capital One credit card with ease.

This secure and convenient online portal allows you to quickly activate your card, ensuring that you can begin enjoying its numerous benefits and rewards right away.

We’ll provide a comprehensive guide on how to guide the activation procedure, whether you pick to do it online or through phone in this article. So, let’s embark on the journey to unlocking the full potential of your Platinum Capital One credit card.

Platinum.CapitalOne.com/Activate

Are you the proud owner of a new Platinum Capital One credit card? Congratulations! You’ve made a smart choice by selecting a card that offers an array of benefits and rewards.

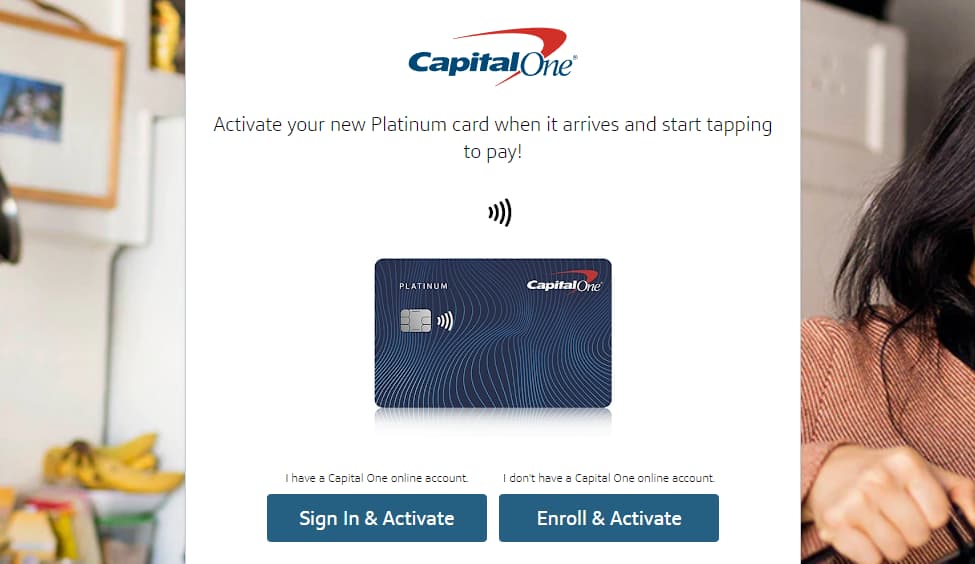

However, before you can start enjoying your new card, you’ll need to activate it at platinum.capitalone.com/activate. Activating your Platinum Capital One credit card is a simple and straightforward process, and in this blog post, we’ll walk you through the steps to ensure a smooth activation. So, let’s dive in!

Locate Your Capital One Activation at Platinum.capitalone.com/activate

- First, you’ll want to gather the necessary information to activate your card.

- When you receive your new Platinum Capital One credit card in the mail, you’ll also find an activation sticker on the front of the card.

- This sticker contains the card activation phone number and a unique URL for online activation.

- Make sure to keep this information handy, as you’ll need it during the activation process.

Choose Your Activation Method

You have two options when it comes to activating your Platinum Capital One credit card: via phone or online.

Both methods are secure and convenient, so choose the one that works best for you.

Option 1: Activate Your Card by Phone

- To activate your card by phone, simply call the toll-free activation number provided on the sticker attached to your card.

- The number is usually 1-800-678-LINK (5465). When prompted, enter the 16-digit card number found on the front of your credit card.

- You’ll also be asked to provide additional verification details, such as your Social Security Number (SSN) or your date of birth.

- Once your card is activated, the automated system will confirm the activation and provide you with any additional instructions.

Option 2: Activate Your Card Online

To activate your card online, follow these steps:

- Visit the activation website by going to the unique URL mentioned on the activation sticker, which should be platinum.capitalone.com/activate.

- Sign in to your account: If you already have a Capital One online account, enter your username and password to sign in. If you don’t have an account yet, you’ll need to create one by clicking the “Set Up Online Access” link and following the prompts.

- Locate the activation page: Once you’re logged in, navigate to the “Activate Card” page. If you can’t find it, use the search bar to look for “Activate Card” or “Card Activation.”

- Enter your card information: On the activation page, you’ll be asked to enter your 16-digit card number, the 3-digit security code (found on the back of the card), and any additional verification details, such as your SSN or date of birth.

- Submit and confirm: Click the “Submit” or “Activate” button to complete the process. You’ll receive a confirmation message that your card has been activated successfully.

Remove the Activation Sticker and Sign Your Card

Once your Platinum Capital One credit card is activated, remove the activation sticker from the front of the card.

It’s also a good idea to sign the back of your card, as some merchants may require a signature for in-person transactions.

Update Any Recurring Payments

If you previously used another credit card for recurring payments, such as subscription services, utility bills, or loan payments, be sure to update your payment information with your new Platinum Capital One card details.

This will help prevent any missed or late payments.

Explore Your Card’s Features and Benefits

Once your card is activated, take the time to introduce yourself with its features and benefits. The Platinum Capital One credit card provides many perks, such as:

- Credit building: The Platinum Capital One card is designed to help you build or rebuild your credit. By paying timely payments and keeping your credit utilization low, you can improve your credit score over time.

- Fraud coverage: Capital One provides $0 fraud liability, which means you won’t be held responsible for unauthorized charges on your account if your card is lost or stolen.

- Account alerts: Customize your account alerts to receive notifications for due dates, account balances, and other essential information. This can assist you to remain on top of your spending and dodging late payments.

- Autopay: Set up automatic payments for your account to assure that you never skip a payment. Autopay can be adjusted to pay the minimum due, the full balance, or a custom amount each month.

- Mobile app: Download the Capital One mobile app to manage your account on the go. With the app, you can track your balance, make payments, view transactions, and access other useful features.

- 24/7 customer support: Capital One offers round-the-clock customer service, so you can get help whenever you need it.

- Access to CreditWise: Capital One’s CreditWise tool allows you to monitor your credit score and receive personalized tips for improving it. This can be a valuable resource for building or rebuilding your credit.

- Travel benefits: Although the Platinum Capital One card isn’t specifically designed for travel rewards, it does offer some travel-related benefits, such as travel accident insurance, auto rental collision damage waiver, and 24-hour travel assistance services.

- Purchase protection: Your Platinum Capital One card comes with extended warranty protection on eligible purchases, as well as price protection, which can reimburse you the difference if you find a lower price on a recently purchased item.

Use Your Card Responsibly

While the Platinum Capital One credit card offers various benefits, it’s essential to use it responsibly to maintain a healthy credit score. Make sure to:

- Pay your bills on time: Late payments can negatively impact your credit score and may result in additional fees.

- Maintain your credit utilization low: Try not to utilize more than 30% of your available credit at any provided time. Increased credit utilization can also harm your credit score.

- Track your Account Regularly: Regularly check your account to assure there are no unauthorized transactions and to keep track of your spending.

- Avoid cash advances: Cash advances typically come with high fees and interest rates, making them an expensive way to access funds.

- Make a budget: Setting a budget can assist you to manage your spending and assure that you can complete timely payments on your card.

Also Check:

- GoHenryCard.com/Activate

- Activate.SYW.AccountOnline.com

- AmericanExpress.com/ConfirmCard

- WellsFargo.com/ConfirmCard

- BankofAmerica.com/ActivateDebitCard

Conclusion:

Activating your Platinum Capital One credit card at Platinum.CapitalOne.com/Activate is a simple process that can be done either by phone or online. Once your card is activated, make sure to remove the activation sticker, sign the back of the card, and update any recurring payments.

By familiarizing yourself with your card’s features and benefits and using your card responsibly, you can enjoy the perks of your new Platinum Capital One credit card while building or improving your credit.